Energy-efficient home improvement tax credits are not a new concept, but in 2023 these potential tax credits are getting a significant increase. The increase is due to congress passing the inflation reduction act of 2022.

This is one of the most significant homeowner energy tax credit acts in years. We will cover the multitude of ways homeowners can benefit from these home energy tax savings.

Increases in Energy Efficient Tax Credits in 2023

The inflation reduction act of 2022 brought about major changes in tax credits for homeowners in two specific ways.

- Increased the percentage that homeowners could receive in tax credits.

- Added more ways for homeowners to save.

Homeowners looking to maximize their tax credit may make additional home investments based on the expanded list of energy updates. Tax credits for home improvement lower your costs and help to increase your return on investment.

How Much Tax Credit Can You Get for a Home Energy Efficient Upgrade?

Before the inflation reduction act, you could receive 10% (up to $500) in tax credits for the cost of an energy efficiency upgrade. This was due to the Nonbusiness Energy Property Credit.

That program ended at the end of 2022. Many people view the new Inflation Reduction Act’s Clean Energy and Efficiency Incentives for Individuals as its replacement.

Under the new law, instead of 10%, you’ll be entitled to 30% of the cost (up to $2000) for a certified energy-efficient home improvement. For example, the incentives state homeowners can receive up to $2000 for an energy-efficient heat pump or biomass stove.

The important thing to keep in mind is that you are eligible for these credits every year through the year 2032.

You will be able to continue to apply for these incentives each year for each upgrade you make.

Before You Get Started on Your Home Energy Improvement Project…

The home energy tax credit is fairly simple to receive. The only major detail is ensuring that the equipment installed meets the energy efficiency standards outlined in the program. This is why it’s important to make sure you’re only working with certified HVAC businesses.

You should ask about federal home energy credits while looking into HVAC companies. If you get a blank stare in response, we recommend looking elsewhere. A salesperson that doesn’t know about the energy benefit program should be considered an HVAC warning sign to look out for.

Maximizing Your Home Energy Upgrade Savings

On top of the home energy tax credits, you’re eligible for, you may also qualify for zero percent financing for a new heat pump or HVAC system. This would allow you to maximize your credit by spreading your purchase over several years without generating additional interest.

If you are comfortable making monthly payments and qualify for zero percent interest, upgrading your heat pump in 2023 will provide you with the highest return on your investment within ten years.

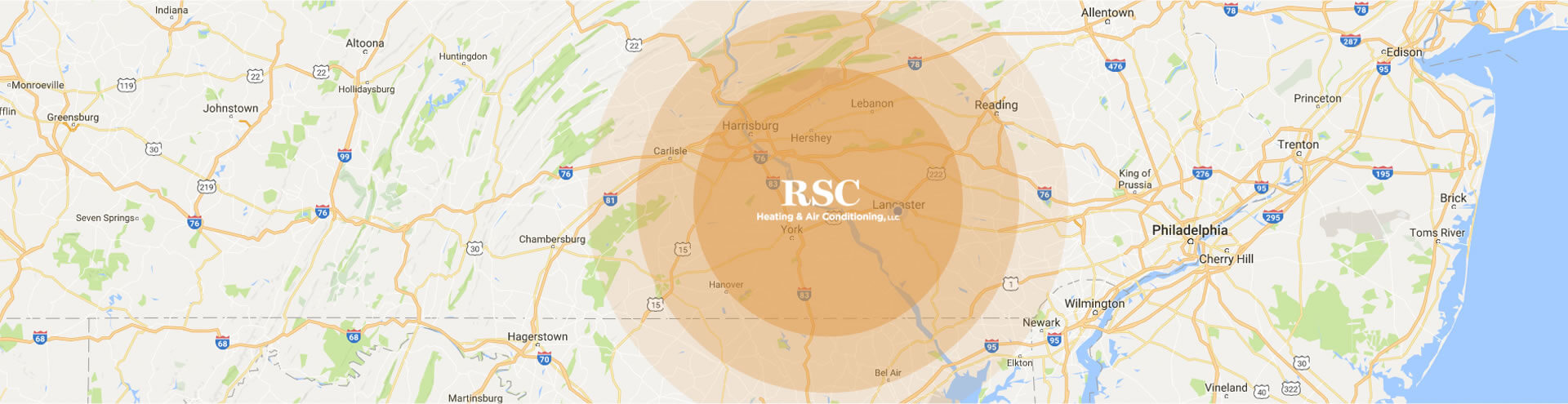

Don’t wait, the sooner you contact your local Lancaster HVAC company about upgrading in 2023 the better. Significant tax credits like this typically cause a boon in the HVAC industry, so expect your local heating and cooling businesses to be quickly filling their calendars.

There truly isn’t a better time to consider this smart investment into your home equity.